- Rich Culture

- Posts

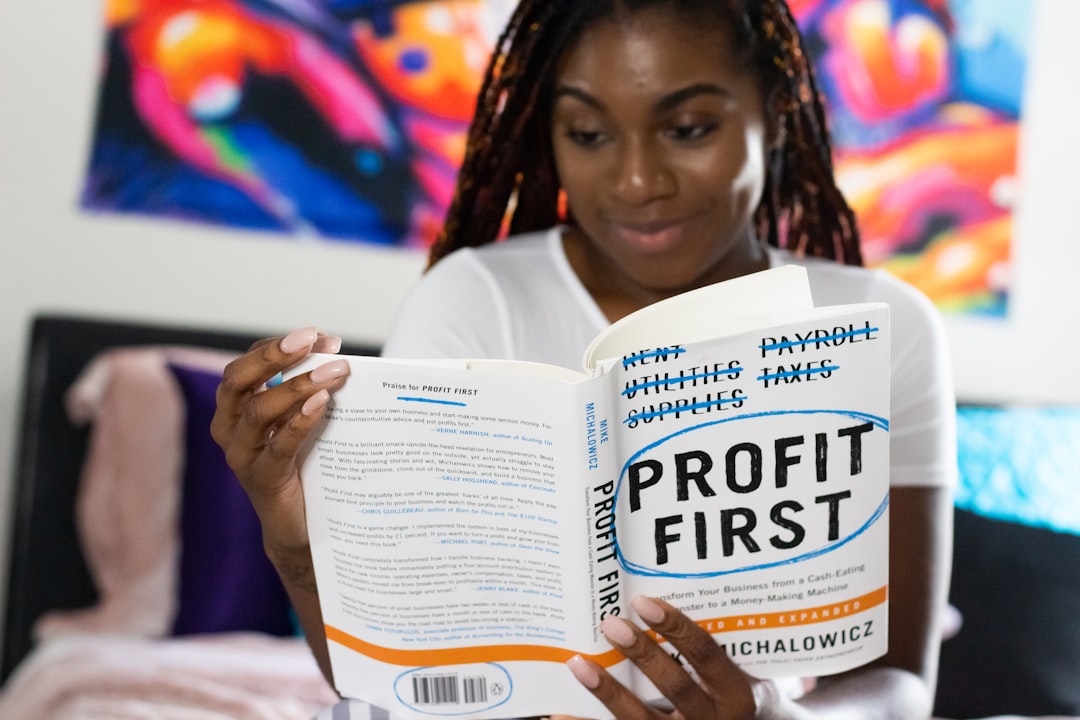

- What Financial Literacy Doesn't Teach

What Financial Literacy Doesn't Teach

3 things everyone should know

Many people think that society is making progress on the obscurity in finance by teaching financial literacy in schools. But in reality, it is just getting worse. Let me show you why.

People think if young people were taught about taxes, things would be better. Meanwhile, the financial literacy programs teach kids how to do taxes, not why taxes exist.

They teach kids how to save money, not how to access money. They teach budgeting and living below means. Meanwhile, to be rich, you have to financially "jump off a cliff" and "bite more than you can chew" so that you can grow.

Money doesn't make people rich. Rich people attract money. More precisely, rich people in the right environment attract money.

The reason we have a disproportionate distribution of wealth today is that we don't teach the truth about money to people early enough. Maybe they are afraid that someone will come up with something better and it will be radically embraced and adopted.

Many do not understand what is money. Even bankers and investors often don't get it right. Currency is not money. Let's start from there.

1. Currency Is a Product

One of the most common misconceptions of money today is that currency is money. Currency is not money. Currency is a product.

If you check the category of companies in your country, you will discover that central banking is a company category. And we know that companies make products or services.

This means whatever central banks produce is their product. Central banks print the currency of the country they are based. They control the circulation of the currency, which the people mostly call money.

The Fed prints the US dollar. The ECB prints the euro. The BOE prints the British Pounds. The BOJ prints the yen. The PBOC prints the yuan. And so on.

This makes a currency a product of central banks. Just like Microsoft Word is a product of Microsoft. This article is a product of Rich Culture. Tesla Model Y is a product of Tesla. PlayStation is a product of Sony. The movie "Extraction" is a product of Netflix. The iPhone is a product of Apple.

In the same way, the US dollar is a product of the Federal Reserve Bank of America. This is what most people call money. The product of someone else is what you strive to get so you can afford the necessities of the lifestyle you want. Think about that.

Now, is that fair? Wrong question. The earlier you stop thinking the central bank notes are YOUR money, the faster you enter into financial liberation.

Today, most transactions are settled in the US dollar globally. It is the world's reserve currency. This means the unit of money in the global financial system is the US dollar.

However, to be rich, you need to go above the system. Some say time is your currency. I disagree. I think brand is your currency.

2. Debt Is Money

Financial literacy teaches people that the more they have in the bank, the better off they are. And that is wrong.

Just because you own the money, doesn't mean you own the money. Remember that it is all currency. And currency is a product. It says on the every US dollar note, "Federal Reserve Note".

Yes, you may own it (temporarily) but it still belongs to the Federal Reserve. And whether you like it or not, they can call it away from you any time they choose.

You say it is your money, but it is in a bank. If the government makes a policy that prohibits withdrawal, suddenly you become poor. If you have 150k in the bank and the policy says that you cannot withdraw more than 15k in a month, then you are no better than someone who just has 15k.

I have seen cases where people's money was seized without them doing anything wrong or illegal. The most popular scenario is people caught in an economic war between two countries where they do business. And their money was seized by the country that considers them a foreign entity. It happens.

Therefore, the flex is not about how much money you have. It is about how fast (and easy) you can replace your money if you lose everything today. It is not about having cash in the bank. Instead, it is about having access to money.

In my first book, I shared how the rules have changed from making money from businesses to taking money to create businesses. You don't start a business to make money. You take money to start a business. That is the modern style. Why?

Debt is money. Debt is unlimited money. Debt makes the world go round. If you can take on debt any time you like, why do you need a pile of money in the bank?

Mind you, big businesses don't pay their debts. They always refinance. They don't plan to ever pay back. Financial literacy won't tell you this.

3. Resources Trump Money

Financial literacy says to go for more money. More money is always the answer. If you have two offers; one pays 150k and the other 200k. Financial literacy tells you to go for the 200k offer.

But what you don't see is the hidden pathways. I always advise young people not to make money the deciding factor for the first 10-15 years of their career. That is if they really love that career and want to be super successful.

Instead, choose access. Choose a place where you have the access and resources to become an industry leader. This is because when you get to the top, you'll have access to all the money.

Financial literacy compartmentalizes finance to just money. Meanwhile, life is so much broader. If you only think about how to make more money or how to get money, you won't have much money.

Multimillionaires and billionaires do not think of how to make money. Thinking about how to make money is not how they got rich. And that is not what is going to keep them rich either.

They got rich by leading a particular industry. The riches you desire is in leadership.

Conclusion

Financial literacy is an educational program that often misleads people about money and finance. Saving, thinking of how to make more money, and living below your means are outdated principles. A more macro mindset is required in today's world:

Currency is a product

Debt is money

Resources trump money

Share this with a friend. Stay rich

Reply